Some assorted Oil Graphs

.PNG)

png.PNG)

.png)

Insight & Critique into the world of energy

.PNG)

png.PNG)

.png)

"Peak Oil is happening as we speak."

"If you don't talk about them, you will never fix the situation."

Posted by

The Energy Standard team

at

13:51

![]()

Steve Keen's excellent Debtwatch blog recently features a video broadcast of his recent lecture about "Debt and Economy - How do we Pay for it all?".

Posted by

The Energy Standard team

at

10:44

![]()

Key oil figures were distorted by US pressure, says whistleblower

Exclusive: Watchdog's estimates of reserves inflated says top official

The world is much closer to running out of oil than official estimates admit, according to a whistleblower at the International Energy Agency who claims it has been deliberately underplaying a looming shortage for fear of triggering panic buying.

The senior official claims the US has played an influential role in encouraging the watchdog to underplay the rate of decline from existing oil fields while overplaying the chances of finding new reserves.

The allegations raise serious questions about the accuracy of the organisation's latest World Energy Outlook on oil demand and supply to be published tomorrow – which is used by the British and many other governments to help guide their wider energy and climate change policies.

A second senior IEA source, who has now left but was also unwilling to give his name, said a key rule at the organisation was that it was "imperative not to anger the Americans" but the fact was that there was not as much oil in the world as had been admitted. "We have [already] entered the 'peak oil' zone. I think that the situation is really bad," he added.

Uh-oh. Reuters, AFP, Telegraph and many more are carrying the same story.

Embrace for impact. Today is going to be really interesting. Expect a thunder of denials.

In related news, as IEA's yearly World Energy Outlook is now coming out, FT has the scoop on the oil price rally of 2008 and the financial crisis.

Did oil cause the latest recession? IEA weighs into the debate

A feature in the draft executive summary of the IEA’s World Energy Outlook, which will be published tomorrow, revisits this argument and comes to a rather worrying conclusion.

It starts out keeping in line with the prevailing view: the run-up in oil prices from 2003 to mid-2008 played “an important, albeit secondary” role in the global economic downturn that took hold last year. Higher oil prices made oil-importing countries more vulnerable to the financial crisis, it says.

So a strengthening belief from the IEA in the contribution of oil prices to the latest recession is especially noteworthy. We will find out on Tuesday if the final draft provides more clarity on the agency’s view.

Well, we already knew as much, but it is always comforting to get the 'official confirmation', so to speak.

These two news put together might go some way explaining the apparent discrepancy in current consumption decline and price increases of longer dated oil futures:

Oil at $100 Doesn’t Compute as OPEC Output Pace Grows (Update4)

OPEC is increasing output at the fastest pace in two years, adding to near-record inventories and threatening speculators betting on $100 crude with losses.

The number of options contracts to buy oil at $100 by March almost quadrupled in October and increased another 5.9 percent so far this month. As traders piled in, OPEC boosted production 4 percent, or 1.1 million barrels a day, since March amid the worst global recession since World War II.

Saudi Arabia’s King Abdullah has targeted $75 oil as a fair price for consumers and producers and has the capacity to increase pumping by about 50 percent, or 4 million barrels a day, enough for all of Brazil. The prospect of more supply comes with inventories in industrial countries already the highest since 1998, when oil collapsed to $10.

“It’s not in OPEC’s interest to see $100 oil,” said Stephen Schork, president of consultant Schork Group Inc. in Villanova, Pennsylvania. “They know that it’s the speculators that are the main driver in sending prices higher. At some point this market will implode, because this isn’t sustainable.”

So, either the speculators never learn (perfectly plausible) or they know something the majority does not know. The dirty details are all in the decline rates and the shape of the peak.

Speculation or not, prices have pushed higher and volatility is killing hedging for commercial users of oil like airlines. Clearly this cannot mean good for the fledging 'recovery'.

Now that economy is officially 'recovering', it's time for oil to step back into the limelight.

Don't say you weren't warned already a year ago.

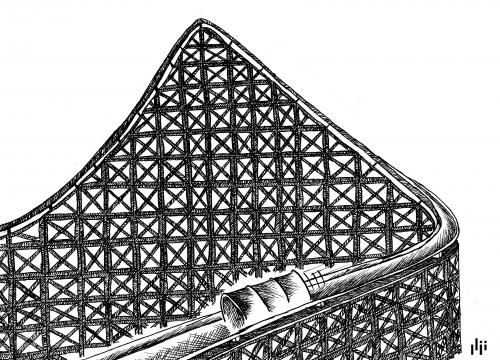

The ride's only starting.

Posted by

The Energy Standard team

at

09:22

![]()