Video for X-mas

Charlier Hall explains energy and Jim Hansen explains investing - both in regards to Peak Oil. Video from ASPO-USA 2008 via Peak Moment TV.

Insight & Critique into the world of energy

Charlier Hall explains energy and Jim Hansen explains investing - both in regards to Peak Oil. Video from ASPO-USA 2008 via Peak Moment TV.

Posted by

The Energy Standard team

at

19:00

![]()

More at Guardian.

Posted by

The Energy Standard team

at

13:57

![]()

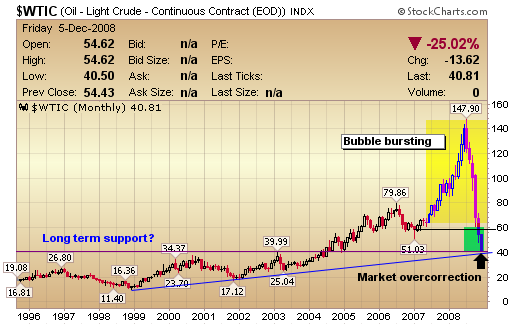

The oil market has become a comedy of sorts. Every minuscule price movement is explained by some temporally correlating event with very little regard to causality.

Hence we get what we got yesterday with Opec's Algeria meeting and announcement of record production cuts. Alphaville blog from FT has the run down.

In short, OPEC announced record cuts. Conveying the message didn't go down too well. Markets were confused: what was the total magnitude of cuts? When will they start to really come into effect? Home much will the excess oil storage now accumulated last? Will the production quotas be honored by the members? What about Iraq's 'special circumstances' that enables it not to adhere to any quotas? Can they pick up the slack?

Thus, the price of oil kept falling and is yet again below $40/barrel, when producers know they need roughly $60-$65 pb to keep on investing.

Either markets are really confused and there will be a huge spike when we get out of the financial mess (not any time soon, mind you), OR we will have an interesting next year, when the cuts and capacity unwinding come into effect and slowly start squeezing the market. There is one more alternative: this will the biggest unwinding in the history of the world ever - everywhere. Markets will not recover in 2009, some not even 2010. Oil consumption and prices will stay low for a decade - as will economic growth. This is not a pretty scenario, but one that each one of us must entertain for now. It does have its upsides as well (emission reduction to mention one).

Currently, IEA/EIA inventories are still growing. And why shouldn't they: it'd be foolish not to fill inventories at these prices. Anybody who's looked at the production data and wants to plan ahead more than a few months, knows this much.

However, once the inventories and reserves are filled and IF demand picks up again, which it usually does at these price levels, get ready for some wild price action again.

When? Nobody knows.

Posted by

The Energy Standard team

at

11:09

![]()

Uh-oh... this was unexpected. The party line has been broken:

"Global oil production will peak much earlier than expected amid a collapse in petroleum investment due to the credit crunch, one of the world's foremost experts has revealed.

Fatih Birol, chief economist to the International Energy Agency, told the Guardian that conventional crude output could plateau in 2020, a development that was "not good news" for a world still heavily dependent on petroleum.

Three years ago the Paris-based organisation still denied there was any fundamental threat to the world's petroleum economy."

What is the party line in the rapidly sinking UK?

Oh, how you will learn the might of the reality. George Monbiot's take on the situation is blunt:"The government does not feel the need to hold contingency plans specifically for the eventuality of crude-oil supplies peaking between now and 2020."

"Around 2020. That casts the issue in quite a different light. Birol's date, if correct, gives us about 11 years to prepare. If the Hirsch report is right, we have already missed the boat."

Posted by

The Energy Standard team

at

08:25

![]()

The always interesting Financial Sense podcast series recently ran an interview with Matthew Simmons & Robert Hirsch (Dec 13, 2008). Here are their quick bios for the gentlemen interviewed:

|

|

|

|

Posted by

The Energy Standard team

at

17:13

![]()

Your daily dose of standard bad news.

Posted by

The Energy Standard team

at

18:44

![]()

Posted by

The Energy Standard team

at

15:35

![]()

U.S. government's National Intelligence Council recent report Global Trends 2025: A Transformed World states:

"All current technologies are inadequate for replacing the traditional energy architecture on the scale needed, and new energy technologies probably will not be commercially viable and widespread by 2025."That was the optimistic official report.

"The market can stay irrational longer than you can stay solvent."FT is reporting the margincal cost of production for KSA is near $40-50. For offshore US and Mexican oil it's closer to $65 (new projects). So much for 'bubble'.

Posted by

The Energy Standard team

at

12:58

![]()

Not only from finance vehicles out of gas, but also from energy companies out of cash.

It's going to get a lot more uglier, before it gets better. Funnily enough neither industry's downfall - as deserved as it may be - is good for our energy infrastructure investments, which are being postponed left and write as this is being written.

If we ever come out of this slump swinging and with gusto, expect an energy crunch like no other (yes, including the 70s).

Posted by

The Energy Standard team

at

19:00

![]()

The forced hiatus of The Energy Standard has been caused by the relentless stream of necktie damage flowing our way from New York and London financial centers.

Being forced to understand the alphabet soup and where the world is headed has not left much time for energy analysis not to mention writing energy posts.

That's the explanation. Now for the summary:

Posted by

The Energy Standard team

at

23:31

![]()