Global Trends 2025

U.S. government's National Intelligence Council recent report Global Trends 2025: A Transformed World states:

"All current technologies are inadequate for replacing the traditional energy architecture on the scale needed, and new energy technologies probably will not be commercially viable and widespread by 2025."That was the optimistic official report.

The conclusion of the report is based purely on issues relating to geopolitical instability of oil delivery originators & routes, resource base issues, required energy investments against the growing demand. Yes, demand is slipping now. That gives us a breather.

The report has no mention of oil peak. Weird that. For something that is geologically indisputable and even dealt in Science. I guess politicians and policy wonks can ignore physical reality.

Or, perhaps one can imagine oil peak added to the report and one gets the pessimistic classified version.

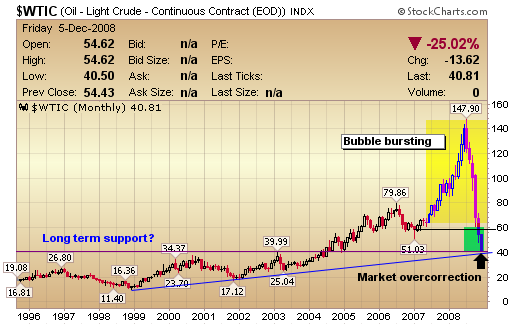

Why is oil at $40?

We turn to John Maynard Keynes for the answer:

"The market can stay irrational longer than you can stay solvent."FT is reporting the margincal cost of production for KSA is near $40-50. For offshore US and Mexican oil it's closer to $65 (new projects). So much for 'bubble'.

The current price level cannot sustain new investments.

Bank of England warned in May 2008 - when oil was still at $100+ - that a drop in oil price would worsen the energy squeeze once we come out of the recession, as not enough investments would have been made.

IEA has been saying the same now for a year. Simmons & International for a few years.

So when oil crunch hits and you are told "nobody could have seen this coming", you know you've been had.