Thursday, 31 March 2011

Wednesday, 23 March 2011

Fossil Fuels in 338 Seconds

Do you want a really quick introduction to fossil fuels, energy use, economics, ecological issues and global warming?

Here it is - 200 years of past and guesses about the next 100 years:

Well worth watching.

Monday, 14 March 2011

A Comedic Diversion

Watch it before it's taken down by the copyright police:

If it's not up anymore, try looking for the Real Time with Bill Maher show from March 11, 2011 (episode 205).

4 and a half minutes well spent.

Posted by

The Energy Standard team

at

12:33

![]()

Saturday, 12 March 2011

Peak Oil Politics - Why Important Decisions Are Not Made

The following video excerpt from the 2007 Oil shock simulation is a good reminder of why important peak oil related conservation, energy infrastructure, military or energy transition decisions are not made, even though the issues are understood fairly well:

Thursday, 10 March 2011

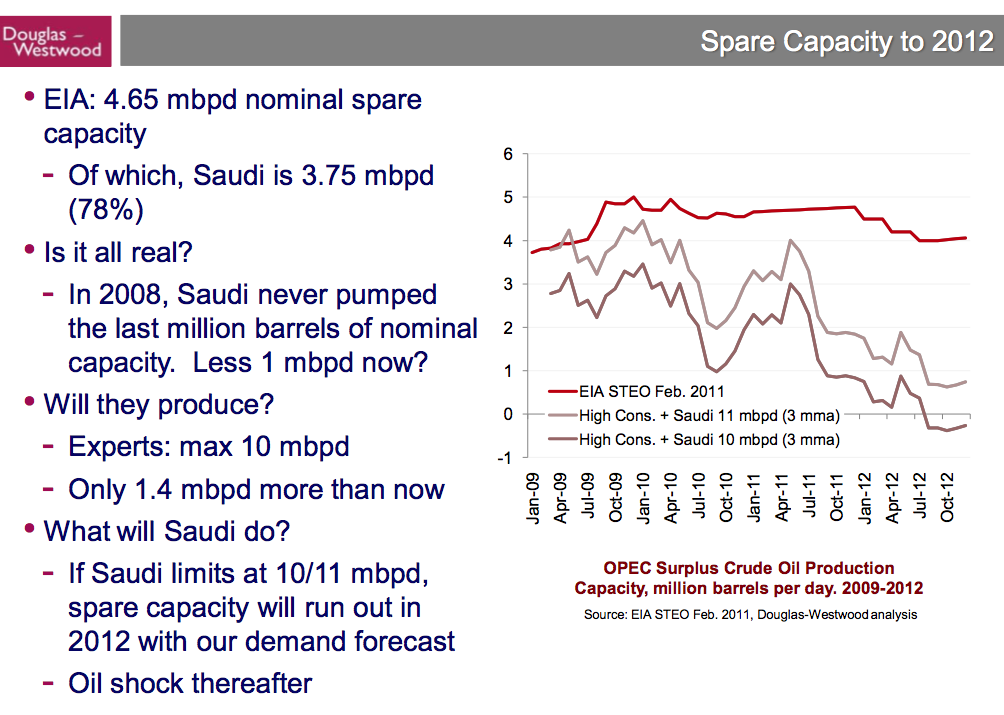

Oil production Spare Capacity in 1 slide

Since the revolutionary spirit started spreading to Libya, markets have been very nervous about oil.

The official line has been that there's c. 5 million barrels of spare capacity within OPEC, so even if the whole of Libya production went offline, it would not cause a crisis.

And from that the discussion has exploded to all directions mainly from people who do not have an inkling of an idea what the supply/demand issue is.

So, Steve Kopits (Douglas-Westwood consulting) to the rescue. He sums up the situation in this one slide of his recent 'Oil, The Economy, and Policy' presentation:

So, there you have it. Oil shock by end of 2012 or shortly thereafter. Even if Libya and the rest of the Arab nations keep producing with very little hiccups.

John Fullerton : World too reliant on fossil fuels, local productions brings resiliency

John Fullerton (The Capital Institute), formerly from JP Morgan, now understands that infinite growth is impossible in a finite world. He now talks about resilient (lower efficiency) systems, local production, fossil fuel free local production and avoiding ecological crisis.

Here's Mr. Fullerton talking about these issue in a short 4 minute interview clip courtesy of Institute of New Economic Thinking.

So yes, even brain-washed bankers can get it. They just need to let go of dogma and look at science. The truth prevails in the end, even though it might take a bit of time.

One can watch the rest of the interview pieces on Youtube.

Posted by

The Energy Standard team

at

18:49

![]()

Tags: ecological crisis, resiliency, steady state economics, systems science

Monday, 7 March 2011

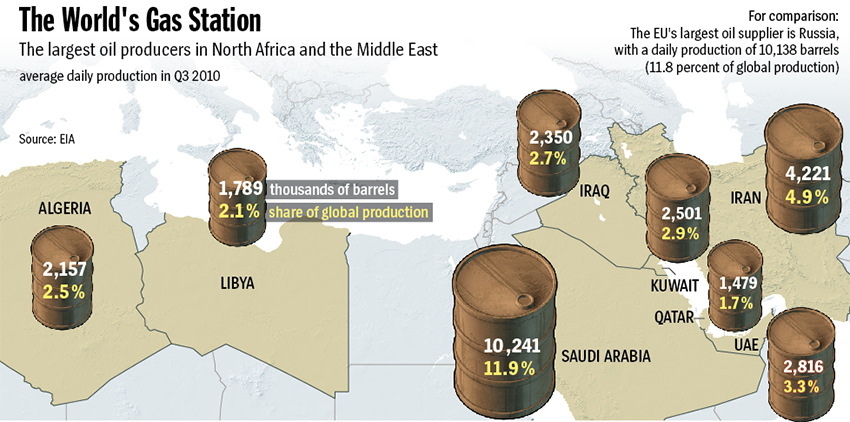

If Middle East goes, so goes the world...

From Spiegel:

A combination of any two countries from the above map is enough to wipe out the whole spare capacity.

Even if oil is in a parabolic trading move right now and likely to come down for a while, it doesn't meant the the problem will be over.

Until the unrest in ME starts to cool down, the prices will be fluctuating a lot.

Traders market, you have been warned.

Posted by

The Energy Standard team

at

21:46

![]()

Tags: Middle East, oil price, OPEC, spare capacity

Sunday, 6 March 2011

MyWorld 2050 - GIGO in action

The UK Propaganda Department of Energy and Climate change has released their energy policy toy, called MyWorld 2050.

The idea is to let people play around with energy supply, like fossil fuels, nuclear and alternatives, and then match this with the demand coming from industry, housing, heating, transport and travel.

The goal: get to 80% CO2 reductions by 2050.

You can try the model yourself at the MyWorld 2050 web site.

Now, some issues that the model behind the game doesn't lay bare:

- There is extremely low probability that oil will flow at 50% of current levels in 2050. There just are not enough resources, drill holes, tankers and manpower.

- Not using fossil oil creates a liquid fuel problem, which the model suggests one fix with biofuels. The problem is that the model assumes we can burn the rest of the developing world's (who have all the money, btw) food for fuel. And the model further assumes this will reduce CO2 emissions and be net energy positive. The premises behind that logic are faulty.

- Clean coal and gas power are supposed to give a 15 point CO2 cut. Eh, where exactly do we have clean coal? And oh, the North Sea gas is mostly in decline by 2025 (remember the model is originally for UK).

- Hydrogen cell powered cars. Sigh, that's like selling second order financial derivatives on a lollipop you have already eaten. Most sane thinkers thought we we past that already.

The more technically minded can download the 2050 Pathways Excel spreadsheet (Office 2010 format, thank you DECC idiots) that reveals some of the thinking behind the model.

Posted by

The Energy Standard team

at

17:21

![]()

Tags: alternative energy, biofuel, coal, energy scenario, oil