Friday, 30 April 2010

Friday, 16 April 2010

Hedging Peak Oil

What does BlackRock - the world's largest hedge fund think of peak oil?

This one picked from their 2010 investment presentation:

Hey, at least they have two different scenarios and you get more than 4 years to prepare. It's unfortunate that they take the other fossil flow rates from the IEA data as is. They are surely to be just as wrong as the oil rates have been.

Tuesday, 13 April 2010

US military: massive oil shortages by 2015

This is starting to sound like a broken record already, but now it's the turn of US military Joint Forces of Command who have prepared a study for military leaders to warn about coming oil shortage:

- By 2012 oil production surplus capacity could disappear

- By 2015 shortfall of oil could reach 10 million barrels per day

- This would slow down economic recovery

- ... which in turn would exacerbate geopolitical tensions

- ... which could turn into resource grab wars

So much for biofuels replacing the shortfall, eh?

There is a further gem in the reporting of the study by Guardian:

"US military says its views cannot be taken as US government policy but admits they are meant to provide the Joint Forces with 'an intellectual foundation upon which we will construct the concept to guide out future force developments.'" - Guardian

That is, "please don't take this seriously, but be prepared for it to be the official stance any time now". Just so that you know.

Posted by

The Energy Standard team

at

16:03

![]()

Thursday, 1 April 2010

US Dept of Energy : Oil Crunch 2011-2015

This is starting to look like a coordinated news campaign or a real wake-up:

"A chance exists that we may experience a decline of world liquid fuels production between 2011 and 2015 if the investment is not there"

- Le Monde on interview of Glen Sweetnam, the oil market expert of US Energy administration

The situation is simply the following:

Many major oil producing regions are heading to a temporal investment related production peak or final oil flow peak by 2015

New discoveries and new producing fields are not there to offset the decline

The major additions from unconventional oils and biofuels (esp. US ethanol) are in serious doubt

So called 'above the ground factors' (i.e. politics, pricing, market issues) are making the flow of oil even harder to predict

So everything written here and elsewhere for the past 5+ years is coming to pass.

Except now it is becoming official. Currently it is confined to being mere political 'scare talk', but when it becomes fully priced in the markets, you can consider $80/barrel oil extremely cheap. And by then, it'll be way too late.

Posted by

The Energy Standard team

at

09:19

![]()

Tags: DoE, oil crunch, peak oil

Thursday, 25 March 2010

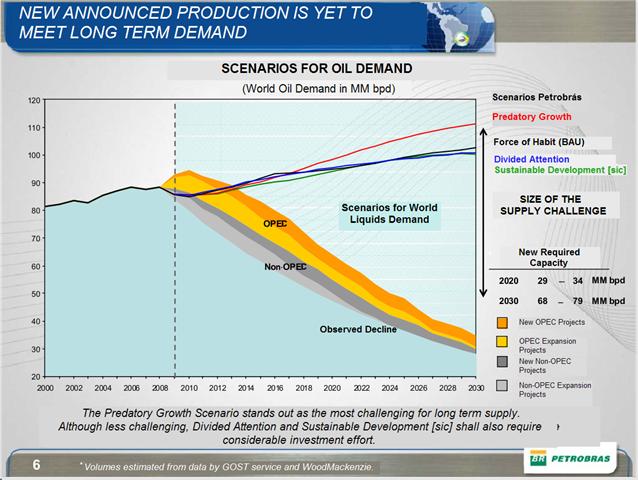

Petrobras - Global Oil Peak (incl. biofuels) 2010

Ah, those magnificent Brazilian sub-salt oil finds that heralded the end of peak oil. Never mind the fact that they would at best postpone the global oil peak roughly 90 days or so.

Well, now the Brazilian oil company Petrobras' CEO, Lucio Pementel, is throwing more fuel to the fire by saying the world oil production will peak this year (via TheOilDrum).

Due to reduced demand from the Great Financial Crisis v1.0 (v. 2.0 coming soon to an economy near you), the supply-demand crunch should not hit us until 2013 or 2014 in their projects.

So again, that pesky 4 years of extra breathing room is there. At best. If we are lucky.

... because two economists have calculated that the demand has not peaked and that demand projections by the big three (i.e. IEA, EIA and OPEC) are underestimated by roughly a third.

Oops!

Tuesday, 23 March 2010

... and the news just keep on coming in : 'Peak Oil is here'

University of Oxford researchers from the Smith School are next in line in their 'The status of conventional world oil reserves — Hype or cause for concern?' in Energy Policy.

In summary, they state:

- conventional oil is peaking

- biofuels cannot fill the gap - not enough land for food and biofuel production

- unconventional oil is way too CO2 intensive - need an alternative

- not enough investments into alternative liquid fuels

In a related interview the founding director of Smith School, Sir David King, warns (again) about shortages and oil price spikes in coming years.

The question is not any longer whether the cat is out of the bag, but for how long can the mainstream politicians control the information and keep the masses calm.

Never mind, keep the music playing! Economy is recovering, unemployment is decreasing, house prices are bouncing, car sales are booming and oil consumption is....

Posted by

The Energy Standard team

at

15:30

![]()

Tags: interview, oxford university, peak oil, study

Monday, 22 March 2010

Uh-oh, guys - no need to worry, right? Right?!

First, FEASTA releases a report titled 'Tipping Point: Near-Term Implications of a Peak in Global Oil Production' earlier this month. It basically states:

- Peak Oil will reduce economic growth

- Our money system is based on credit

- Reduced economic growth cannot service the debt load

- Globalized Just-on-Time supply chains are highly vulnerable to supply shocks

- Global trade rests on cheap and uninterrupted oil supply

- Our IT infra is dependent on constant resupply - interruptions are bad

- Food system is fossil fuel dependent throughout

- Initial Peak Oil collapse will start by money starting to chase real goods

- There is at least 16 times as much funny money as there is goods or services in the world

- Things fall apart; the center cannot hold

In short. We are fukked.

But not to worry, politicians to the rescue!

UK Energy minister, Lord Hunt himself, is meeting up with industrialists in London to quell fears about oil supply disruptions.

Thank god for the smart politicians and their tremendous foresight! Phew! All is saved. God save the Queen.

The countdown has begun...

Friday, 12 March 2010

Jeremy Rifkin gets peak oil (per capita) & peak globalization

Jeremy Rifkin, who wrote a was at Google for the Authors@google talks to talk about his new book 'Empathic Civilization'.

Jeremy Rifkin: The Empathic Civilization (50 mins)

"The entire economic engine of the industrial revolution turned off at 147 USD a barrel.

Our fossil fuel energies are sunsetting.

The entire infrastructure of this civilization is embedded in the carbon deposits of the Jurassic age. Our agricultural food is grown in petrochemical fertilizers and pesticides. Almost all of our pharmaceutical products are still fossil-fuel based. Most of our clothes... The entire construction infrastructure of civilization is fossil-fuel-based. Our power, transport, our heat, our light, our logistics, our supply chain. What we are seeing is the sun-setting of these energies and the life support of the infrastructure built from them.

That's what we haven't yet come to grips with." - Jeremy RifkinHighly recommended.

Posted by

The Energy Standard team

at

15:18

![]()

Thursday, 11 March 2010

Kuwait Researchers - Conventional Oil Peak 2014

A new paper titled 'Forecasting World Crude Oil Production Using Multicyclic Hubbert Model' in the journal Energy & Fuels by Ibrahim Sami Nashawi, Adel Malallah and Mohammed Al-Bisharah of Kuwait University and Kuwait Oil company shows a new analysis of World oil peak production for conventional oil. Their estimate for peak of conventional oil is 2014. Their implied world production decline rate is somewhere in the vicinity of 2.6% p.a.

World Oil production peak and cumulative estimates

Conventional is important, as it accounts for roughly 80% of the world's oil production. No known alternative, whether unconventional, biofuels or natural gas liquids can fill the gap left behind by conventional oil depletion.

Four years to peak is also significant, as we know from previous studies that a proper precautionary crash course mitigation program for peak oil would take roughly 20 years. That is, 20 years before the peak, which is now forecast to be within four years by the Kuwaiti researchers.

"Forecasting is not accomplished by consulting a crystal ball or a mystic of some sort, but by appraising the past, inspecting present conditions, and projecting these into the future based on the best available information."

Their decline rate, while optimistic by historical accounts, is a sigh of semi-relief. If true, it'd mean a much less of a downslope of production loss than imagined by many other authors. This would give the world more time to adjust in an ordered manner. However, based on the decline rates of real fields in the world, driven by the best technology, their estimate of seems fairly optimistic. If the true decline rate is three times as high as it seems likely, it remains very unlikely that any society, except the oil exporting nations within yet-to-peak faction of OPEC have any time to structurally adjust to the change.

Why is this information still not on the front page of every newspaper on earth? Because it is bad news, it's abstract, it can always be denied due to commercial/geo-political reasons, and people just do not understand the ramifications of oil peak.

For people writing about oil depletion finding supportive research can always feel rather schizophrenic. One one hand it is easy to feel vindicated about years of work of trying to get others to understand. On the other hand it is evident that people still do not get it and would rather just stick their head in the sand. This implies that on the average we all deserve what's coming to us.

Yet, four years is a long time. One can still do a lot of things personally in that time, even though it is very unlikely to change the big picture for all of us. It can also whizz by in an instant, depending on the choices one makes.

If you knew for sure that you had roughly four years before the slow decay really starts to kick in and turn a lot of good things into mush, then the only relevant question remaining is this:

What would you do if you had 4 years to prepare?

Posted by

The Energy Standard team

at

13:43

![]()

Thursday, 4 March 2010

Dennis Meadow's on Growth, Collapse and Peak Oil

8:30 - good for a cup of tea and some brain teasing

"How can Societies expect [growth] when we face [oil decline]... and what policies do we have in order to be peaceful and equitable... It's possible if we prepare, but if we deny the problem then we will never manage.

- Dennis Meadows

Posted by

The Energy Standard team

at

11:06

![]()

Subscribe to:

Posts (Atom)